How Much PAs Make After School

It is not advisable to pursue a career for the salary alone, but if you are considering PA school, you must weigh the financial impact. PA school can be expensive, and the salary after should be considered.

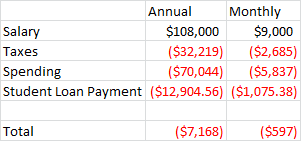

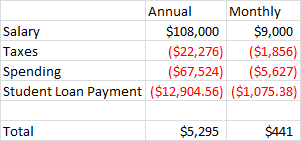

If you are a recent graduate or are thinking about becoming a PA, here is an example of how much you will be bringing home after taxes and other expenses. Physician Assistant salaries of $108,000 were used in the examples below.

Taxes were estimated using a tax calculator to find estimates of different situations. In the first example, the numbers are for a single person in San Francisco, California. The second sample shows the monthly spending for a married couple in Des Moines, Iowa. All numbers used are estimates and may vary by individual circumstances.

According to a report by the Physician Assistant Education Association (PAEA), students graduating from PA school expect to be in debt about $100,000; using a student loan calculator, the standard monthly repayment for this amount would be $1,075.38. The student loan payments are based on an interest rate of 5.3%, which is the current interest rate for Federal Plus loans.

A factor in how far your salary will go depends on where you live. The AAPA has a cost of living calculator that allows you to see estimates of what it will cost to live in different areas of the country. The calculator will let you compare two different cities, so you can see the difference if you were to move to a new location, for a single person living in Los Angeles and renting, the monthly expenses would be $5,837.

The examples above use averages, the numbers can vary greatly depending on individual circumstances such as family size, student loan amount, salary, student loan repayment plan, etc. Looking at the first example, with an average PA salary of $108,000, after subtracting expenses out of your paychecks, such as taxes, monthly spending, and student loan payments, you would be in the negative every month.

It is often difficult to think about how student loan debt will affect you in the future, and the exact numbers can be hard to estimate. For people thinking about continuing their education, it is important to understand how it is going to affect you in the future.

PA school can cost $100,000 or more in students loan, and the expected loan repayments are over $1,000 a month. There are many reasons to want to be a doctor, physician assistant, nurse practitioner, physical therapist, or other allied health professionals, and the salary is just one of those reasons, but looking at the cost to get there is another thing to consider. You must know the cost before starting, and the potential salary once working. If you’re planning on going to PA school, be sure to have a plan on how you will pay back your student loans before starting school.

Have you created a budget for after you’re done with PA school? Please comment below the original post, sign up to receive future posts by email and share with your friends!