A Check-Up on My Student Loans

When you have student loans and a goal to pay them off, it is important that you check in on how you’re doing. Right now I’m not doing too well. I’m currently in an income-based repayment plan to help lower my monthly payments, but this does not help me pay my loans off any quicker.

When Life Happens Adjust Your Plans

When I first graduated PA school I worked for a non-profit hospital that was a qualifying employer for public service loan forgiveness. My plan was to work for a non-profit employer for the ten years needed to get forgiveness.

Unfortunately, life happens and things don’t always work the way we plan. After working for three years we had our first child, and decided to move closer to family. I had a few different job offers, but the best fit for me was for a multi-specialty private practice. As a private practice it is not a qualifying employer, and I would no longer qualify for the public service loan forgiveness program.

[jetpack_subscription_form title=”Don’t miss out on information about PA student loans” subscribe_text=”Enter your email address to receive future posts by email for FREE” subscribe_button=”Sign Me Up”]

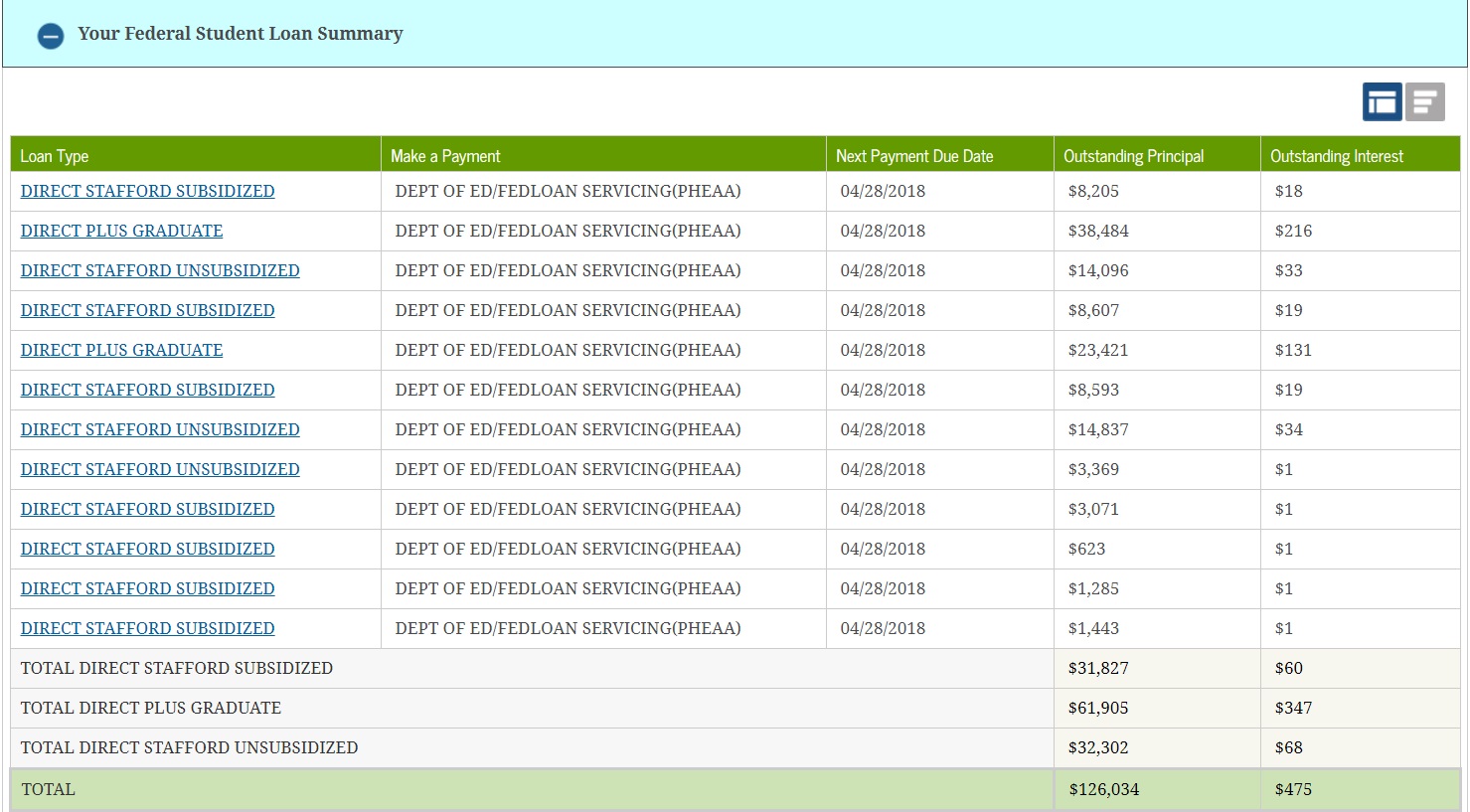

I had to adjust my plan, and now my goal is to get them paid off in the next five years. As you can see from the chart below that would be about $25,000 per year. I changed my contribution to my 401k to focus on paying my school loans and this past year would have been able to do this, however…life happens.

Buying a New Home

Late last year we found an opportunity to purchase a new home. Our third child was just born and the things we want in a house are different than when we purchased our current home. The only issue is that the home we purchased is a bit of a fixer upper, so the money we have in savings is tied up currently.

My hope is that we can get the new home ready to move into before selling our current home, and use some of the money on the sale of the home to put towards student loans. It’s totally risky and stressful and if you’ve ever read Dave Ramsey it goes completely against what he recommends, but everyone has to figure out what’s best for them and their situation.

Hopefully, everything goes as planned, but in the mean time I’ll keep plugging along and slowly get my student loans paid off.

Are you paying off student loans? Have you had to change your plans from when you first started? What’s your current plan/goal? Don’t forget to sign up to receive future posts by email, please comment below the original post and share with your friends!

Love the honesty of this post. Thanks for sharing!

Thanks for the comment. I hope it is helpful to someone looking at taking out student loans.